All Categories

Featured

Table of Contents

It's important to remember that SEC policies for certified investors are designed to protect capitalists. Without oversight from monetary regulators, the SEC simply can't examine the danger and reward of these investments, so they can not supply info to educate the average financier.

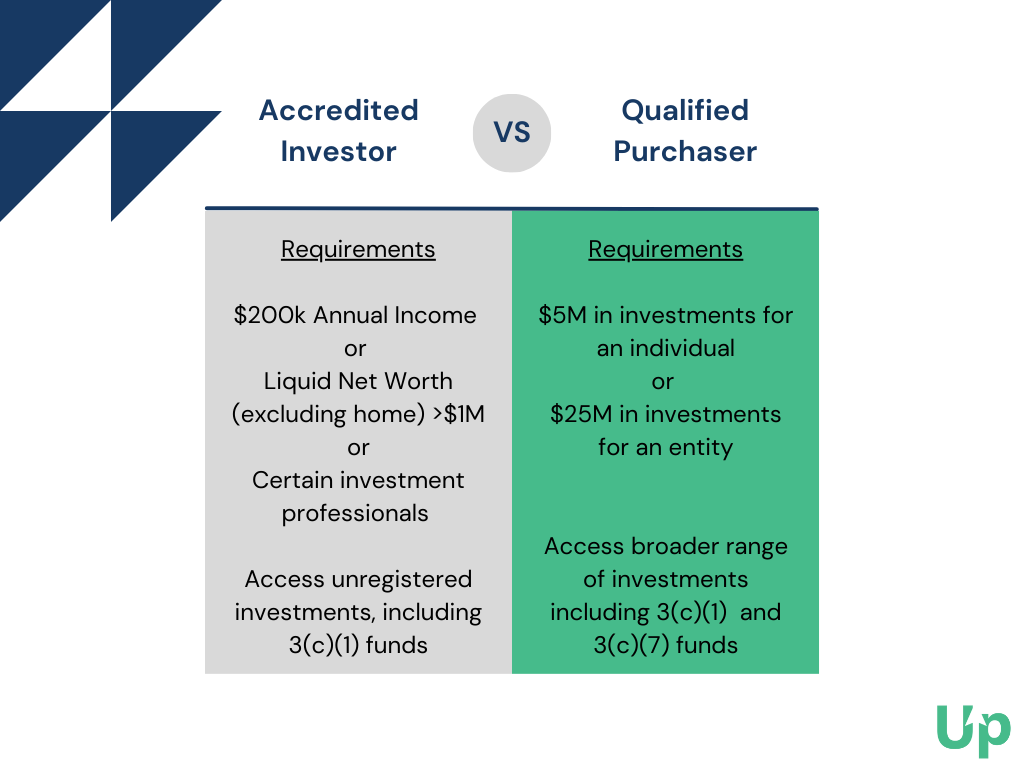

The concept is that investors that gain sufficient revenue or have sufficient wide range are able to soak up the danger far better than capitalists with reduced revenue or less wealth. accredited investor real estate deals. As a recognized investor, you are expected to finish your own due persistance prior to including any possession to your investment portfolio. As long as you meet one of the following four demands, you certify as an approved investor: You have earned $200,000 or even more in gross earnings as a private, every year, for the previous two years

You and your partner have had a combined gross earnings of $300,000 or even more, annually, for the past 2 years. And you anticipate this degree of earnings to proceed. You have a web well worth of $1 million or more, omitting the value of your main home. This implies that all your possessions minus all your financial obligations (omitting the home you stay in) total over $1 million.

Superior Accredited Investor Real Estate Investment Networks

Or all equity proprietors in the business qualify as certified investors. Being a recognized capitalist opens up doors to investment possibilities that you can't access or else. As soon as you're certified, you have the alternative to purchase uncontrolled securities, which consists of some impressive investment opportunities in the real estate market. There is a large array of property investing strategies available to capitalists that don't currently meet the SEC's needs for certification.

Becoming a recognized capitalist is simply a matter of verifying that you meet the SEC's needs. To verify your earnings, you can provide documentation like: Tax return for the past two years, Pay stubs for the previous two years, or W2s for the previous 2 years. To confirm your internet worth, you can provide your account declarations for all your properties and responsibilities, including: Cost savings and inspecting accounts, Investment accounts, Outstanding lendings, And realty holdings.

Exceptional Venture Capital For Accredited Investors for Accredited Wealth Opportunities

You can have your lawyer or CPA draft a confirmation letter, verifying that they have examined your financials and that you fulfill the needs for a recognized capitalist. It might be extra cost-effective to make use of a solution specifically created to validate accredited financier conditions, such as EarlyIQ or .

, your certified investor application will be processed via VerifyInvestor.com at no expense to you. The terms angel financiers, sophisticated capitalists, and approved capitalists are typically utilized mutually, however there are refined differences.

Normally, any individual that is approved is assumed to be an innovative investor. The income/net worth needs stay the very same for international capitalists.

Here are the most effective investment opportunities for accredited financiers in genuine estate. is when capitalists pool their funds to buy or refurbish a residential or commercial property, after that share in the profits. Crowdfunding has actually become one of the most preferred approaches of buying realty online since the JOBS Act of 2012 allowed crowdfunding systems to provide shares of realty tasks to the public.

Dependable Accredited Investor Funding Opportunities

Some crowdfunded realty investments don't need accreditation, but the projects with the best prospective incentives are generally booked for accredited financiers. The difference in between projects that approve non-accredited financiers and those that only approve recognized financiers normally comes down to the minimum investment quantity. The SEC currently restricts non-accredited financiers, who earn less than $107,000 per year) to $2,200 (or 5% of your yearly earnings or total assets, whichever is much less, if that quantity is greater than $2,200) of investment funding each year.

is one of the very best means to purchase property. It is really similar to realty crowdfunding; the procedure is basically the same, and it features all the very same advantages as crowdfunding. The only significant difference is the possession structure. Property syndication supplies a steady LLC or Statutory Trust fund possession version, with all capitalists working as participants of the entity that possesses the underlying property, and a distribute who facilitates the job.

a firm that purchases income-generating realty and shares the rental income from the homes with capitalists in the kind of dividends. REITs can be openly traded, in which situation they are controlled and available to non-accredited financiers. Or they can be exclusive, in which case you would certainly need to be approved to invest.

Market-Leading Accredited Investor Platforms

It's important to note that REITs typically feature several fees. Administration fees for an exclusive REIT can be 1-2% of your overall equity annually Acquisition costs for brand-new purchases can come to 1-2% of the acquisition price. Administrative charges can amount to (accredited investor real estate investment networks).1 -.2% every year. And you may have performance-based costs of 20-30% of the personal fund's revenues.

While REITs focus on tenant-occupied properties with secure rental income, exclusive equity real estate firms concentrate on genuine estate growth. These companies commonly establish a story of raw land into an income-generating residential property like an apartment complex or retail shopping. Similar to exclusive REITs, capitalists in personal equity endeavors typically need to be certified.

The SEC's definition of accredited investors is developed to recognize individuals and entities regarded monetarily sophisticated and efficient in assessing and joining specific kinds of exclusive financial investments that may not be available to the general public. Importance of Accredited Investor Status: Final thought: To conclude, being a recognized capitalist brings considerable value in the world of money and investments.

High-End Accredited Investor Passive Income Programs

By fulfilling the criteria for certified investor status, people demonstrate their monetary refinement and get to a world of investment opportunities that have the possible to create considerable returns and add to long-term economic success (accredited investor crowdfunding opportunities). Whether it's purchasing start-ups, realty ventures, personal equity funds, or other alternative assets, accredited capitalists have the opportunity of checking out a diverse array of financial investment alternatives and building riches by themselves terms

Recognized capitalists include high-net-worth people, financial institutions, insurance provider, brokers, and depends on. Approved investors are specified by the SEC as qualified to spend in facility or sophisticated types of safety and securities that are not closely controlled. Specific requirements have to be met, such as having a typical annual income over $200,000 ($300,000 with a partner or cohabitant) or operating in the financial sector.

Non listed safeties are naturally riskier since they do not have the normal disclosure demands that come with SEC enrollment., and various deals involving complex and higher-risk financial investments and instruments. A business that is seeking to elevate a round of financing may make a decision to directly come close to recognized financiers.

Table of Contents

Latest Posts

Tax Sale List

Invest Tax Liens

How To Invest In Tax Liens Online

More

Latest Posts

Tax Sale List

Invest Tax Liens

How To Invest In Tax Liens Online