All Categories

Featured

Table of Contents

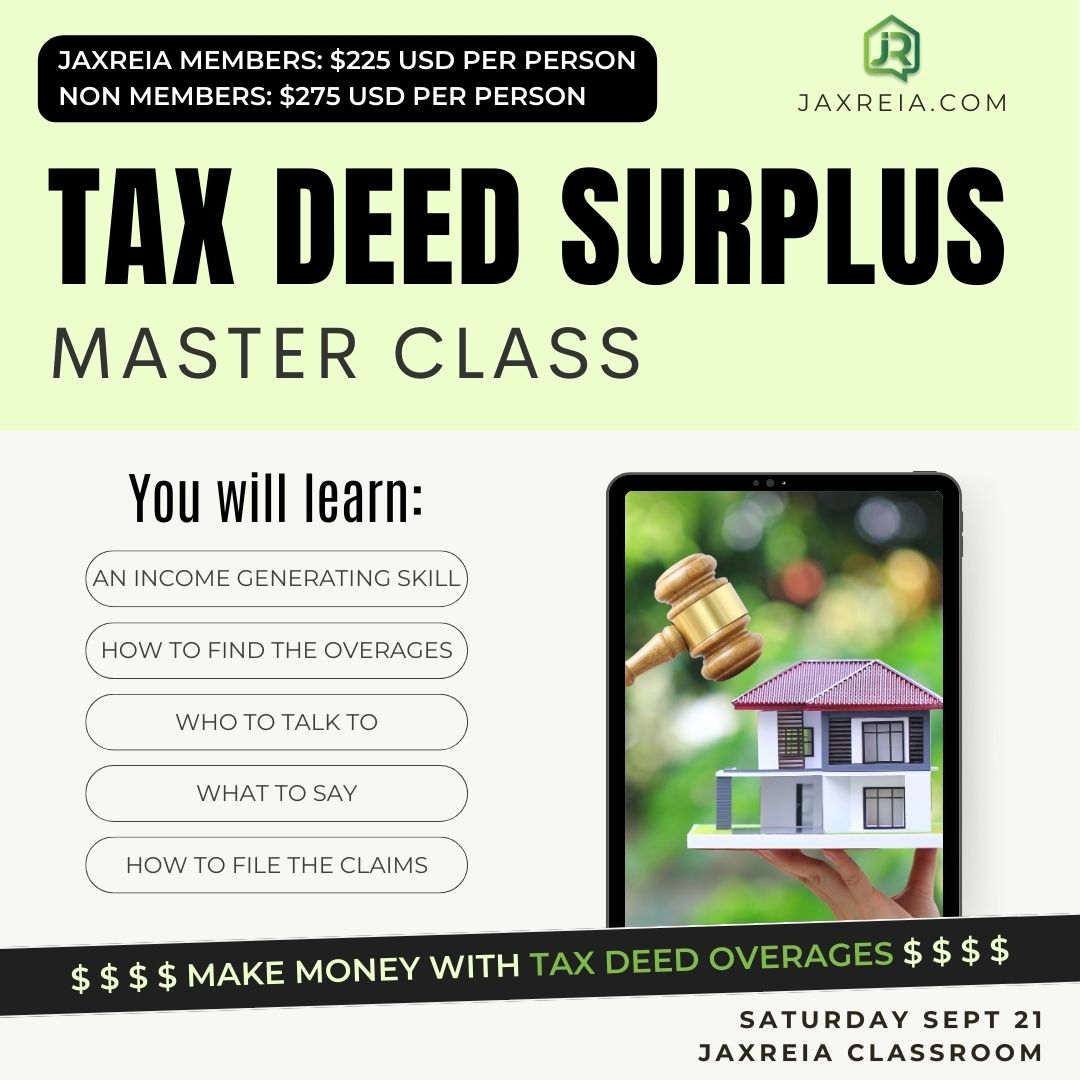

The $40,000 boost over the original bid is the tax sale overage. Asserting tax sale excess indicates obtaining the excess money paid throughout an auction.

That claimed, tax sale overage claims have actually shared features across most states. During this duration, previous proprietors and home mortgage holders can contact the region and receive the overage.

If the duration runs out before any kind of interested parties assert the tax obligation sale overage, the area or state typically takes in the funds. Previous proprietors are on a strict timeline to insurance claim overages on their properties.

, you'll gain rate of interest on your entire quote. While this element doesn't imply you can claim the overage, it does aid reduce your costs when you bid high.

State-of-the-Art Real Estate Overage Funds System Tax Overages Business

Bear in mind, it may not be legal in your state, indicating you're limited to collecting interest on the overage. As mentioned over, an investor can discover ways to make money from tax sale excess. Tax Overages. Since rate of interest income can put on your whole proposal and past proprietors can declare excess, you can leverage your knowledge and tools in these circumstances to take full advantage of returns

An important element to remember with tax obligation sale excess is that in the majority of states, you just require to pay the county 20% of your total bid up front., have laws that go past this policy, so once again, research study your state regulations.

Instead, you just need 20% of the bid. If the building does not redeem at the end of the redemption duration, you'll require the staying 80% to get the tax action. Since you pay 20% of your quote, you can make rate of interest on an excess without paying the full rate.

State-of-the-Art Overages Surplus Funds System Overages Surplus Funds

Again, if it's legal in your state and area, you can collaborate with them to aid them recuperate overage funds for an extra cost. You can accumulate rate of interest on an overage proposal and charge a charge to enhance the overage case process for the previous proprietor. Tax Sale Resources recently launched a tax sale excess item particularly for people interested in pursuing the overage collection company.

Overage collection agencies can filter by state, region, home type, minimum overage quantity, and optimum overage amount. Once the data has actually been filtered the enthusiasts can determine if they intend to include the miss mapped data bundle to their leads, and afterwards pay for just the confirmed leads that were found.

To get begun with this game transforming item, you can find out more here. The best method to get tax sale overage leads Focusing on tax sale overages as opposed to traditional tax lien and tax action spending needs a particular approach. On top of that, similar to any kind of various other investment approach, it supplies special advantages and disadvantages.

Tax Overages List Property Tax Overages

Tax obligation sale overages can form the basis of your financial investment model since they supply an economical method to gain cash. You do not have to bid on residential or commercial properties at public auction to spend in tax obligation sale excess.

Instead, your research study, which might involve avoid mapping, would certainly cost a comparatively little charge.

Favored Foreclosure Overages Course Best States For Tax Overages

Your sources and method will identify the best atmosphere for tax overage investing. That said, one strategy to take is accumulating passion on high premiums.

Additionally, excess use to greater than tax obligation actions. Any kind of auction or foreclosure entailing excess funds is an investment opportunity. On the flip side, the major downside is that you might not be compensated for your tough work. As an example, you can spend hours investigating the past owner of a residential or commercial property with excess funds and call them only to find that they aren't interested in seeking the cash.

You can begin a tax obligation overage organization with marginal expenditures by tracking down info on current residential properties cost a premium bid. Then, you can get in touch with the previous proprietor of the building and offer a cost for your services to help them recuperate the overage. In this situation, the only cost included is the study rather of investing tens or hundreds of hundreds of bucks on tax obligation liens and deeds.

These excess typically create passion and are available for previous owners to case - Tax Overages List. Whether you invest in tax liens or are solely interested in insurance claims, tax obligation sale overages are financial investment chances that need hustle and solid research to transform a revenue.

Custom Tax Overages Program Tax Lien Overages

A celebration of passion in the property that was marketed at tax sale may assign (transfer or sell) his/her right to declare excess proceeds to somebody else only with a dated, written paper that explicitly mentions that the right to claim excess earnings is being appointed, and just after each event to the suggested task has disclosed per various other event all realities associating with the value of the right that is being appointed.

Tax obligation sale excess, the excess funds that result when a home is cost a tax sale for even more than the owed back taxes, costs, and costs of sale, represent a tantalizing possibility for the original home proprietors or their successors to recover some worth from their shed asset. The procedure of asserting these excess can be complicated, mired in legal procedures, and vary considerably from one jurisdiction to one more.

When a property is cost a tax obligation sale, the key objective is to recoup the overdue home taxes. Anything above the owed amount, consisting of fines and the cost of the sale, ends up being an overage - Tax Overage Recovery Strategies. This overage is essentially money that ought to rightfully be gone back to the former home owner, thinking no other liens or claims on the residential property take priority

Table of Contents

Latest Posts

Tax Sale List

Invest Tax Liens

How To Invest In Tax Liens Online

More

Latest Posts

Tax Sale List

Invest Tax Liens

How To Invest In Tax Liens Online